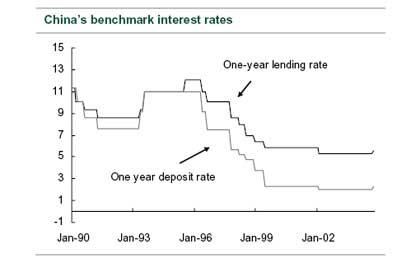

28 October 2004 – The PBOC raised the benchmark 1-year working capital lending rate and 1-year deposit rate both by 27bp to 5.58% and 2.25%, respectively, effective tomorrow. Importantly in our view, the upper ceiling on the lending rate was also removed. This is the first move in interest rates since February 2002 when rates were cut. It is the first rate hike since July 1995. The market had been speculating on a rate hike a few months ago, but speculation recently died down, following recent data showing more evidence that the economy is slowing (GDP growth slowed from 9.6% y-o-y in 2Q to 9.1% in 3Q) and tentative signs that inflation may have peaked (CPI inflation eased from 5.3% in Aug to 5.2% in Sep). So the timing of the rate hike was unexpected (the market seemed to be starting to pencil in a rate hike next year rather than this year), although the size was as expected. However, the removal of the upper ceiling of the lending band was totally unexpected.

The bottom line: The rate hike reaffirms the determination of the authorities to cool down the still rapidly growing economy, and also not let inflation get out of control. We judge that it is also a signal that China is getting closer to moving to a more flexible exchange rate. The rate hike strengthens our view that China’s economy will slow further, so no change to our 8% GDP growth forecast for 2005. We expect no more rate hikes this year, but we do expect further rate hikes next year, taking the 1-year lending rate to 6.0% by end 2005, or possibly higher.

Seven initial thoughts:

1. Signals authorities concerned about inflation, because of high oil prices and some incipient wage pressures. While CPI inflation was 5.2% in September, producer price inflation was 7.9%.

2. Authorities may have hiked because of concern that the real deposit rate is negative and the real lending rate is virtually zero. Negative rates raises the risk of households withdrawing money from the banking system, and credit being misallocated (fuelling property market bubble, for example).

3. The mix of economic growth has been improving (weakening investment, but strong exports and strengthening consumption). Given interest rates are a blunt instrument, the authorities, we have been arguing, have been waiting for more balanced GDP growth before replacing some of the administrative tightening policies with higher rates.

Today’s rate hike could signal that the authorities are pleased with how GDP growth is being rebalanced. This could be a sign that China is starting to lean to more market-based tightening measures, and that the administrative measures will start being wound back. However, our view is that investment is still growing too strongly, and that the tighter administrative measures will not be wound back until next year. In the meantime, the rate hike is another tightening measure that will slow the economy further this quarter.

4. Higher rates could attract stronger capital inflows to China again.

5. The rate hike could mean that the authorities believe more market based measures are needed to cool the economy (they could have been concerned with reports of increased lending in the curb market, to bypass the administrative controls).

6. There is a risk that higher rates could trigger a new bout of NPLs.

7. The first move in interest rates in over two years likely signals that China is becoming more active with interest rate policy, which could mean that China is getting closer to moving to a more flexible exchange rate, given that a flexible exchange rate is needed in order to have policy independence in moving domestic rates. Also critically, the upper 9.03% ceiling on the 1-year lending rate was removed (the lower bound of 4.78% remains), clear evidence that China is deregulating interest rates. This also hints that China is getting loser to moving to a more flexible exchange rate. The reasoning is that a more flexible exchange rate helps equilibrate capital flows, freeing up domestic monetary policy (i.e. interest rates can be used more effectively